A Recession Could Be Possible Before Stellar Growth

If you are thinking the U.S. economy could show stellar performance in 2018, think again. If you look at the data, you might be shocked. A recession could be likely before there’s economic growth.

Understand that the key stock indices aren’t telling the real story. They are driven higher by hopes and optimism. Not by real fundamentals.

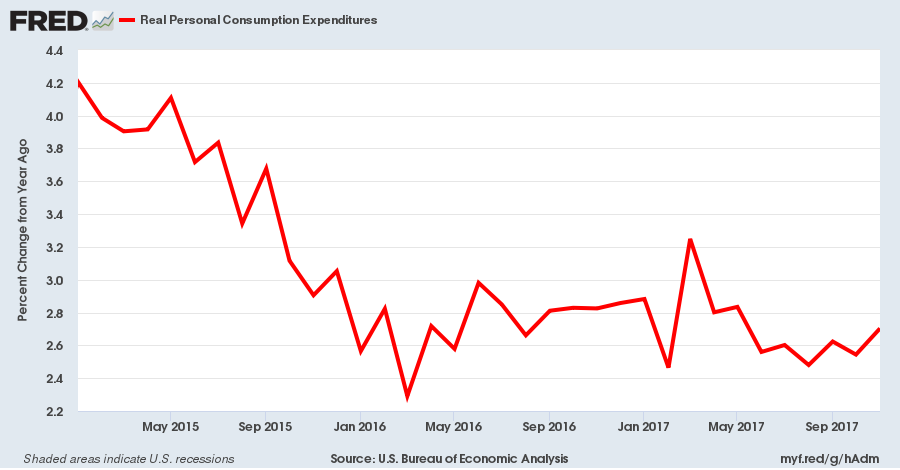

Consumer Spending Slows Down 37%

The first thing that needs attention is consumer spending. It really can’t be stressed enough: American consumers have been behind all the recessions and expansions in the U.S. economy. If consumers buy less, the U.S. economy struggles.

With this in mind, look at the chart below. It shows the year-over-year percentage in monthly personal consumption expenditures in the U.S. economy. It’s one of the best indicators of consumer spending.

(Source: “Real Personal Consumption Expenditures,” Federal Reserve Bank of St. Louis, last accessed January 17, 2018.)

Certainly, consumer spending is growing, but the pace of growth has declined significantly. In early 2015, it was around four percent. Now, it hovers close to 2.5%. In percentage terms, one could say that consumer spending growth has slowed down by over 37%.

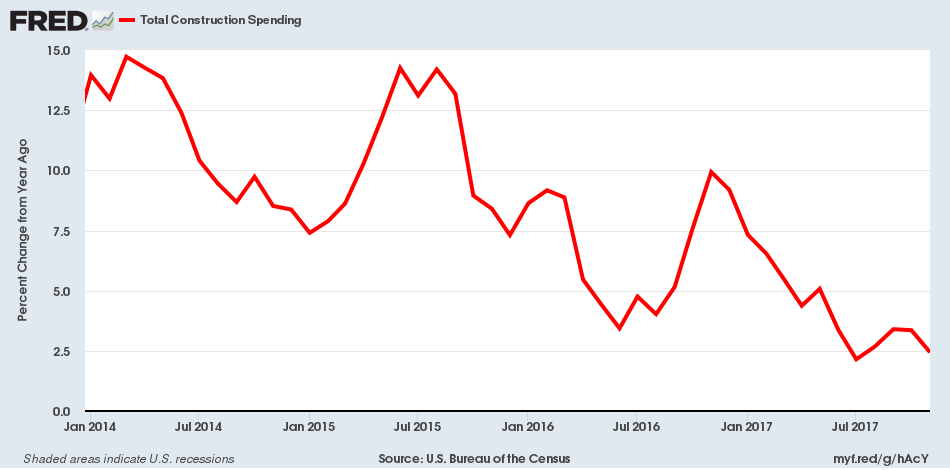

Construction Spending Continues to Tumble

Beyond this, look at the construction spending figures. Over the past few years, the growth rate in construction spending has stalled immensely as well. As we see it, this is saying that an economic slowdown is fast approaching. Just look at the chart below:

(Source: “Total Construction Spending,” Federal Reserve Bank of St. Louis, last accessed January 17, 2018.)

The construction spending growth rate was close to 15% in early 2014. Now, it’s at 2.5%. This is a massive deceleration.

With interest rates going higher, this rate will decline further. It actually wouldn’t be shocking to see a contraction in construction spending.

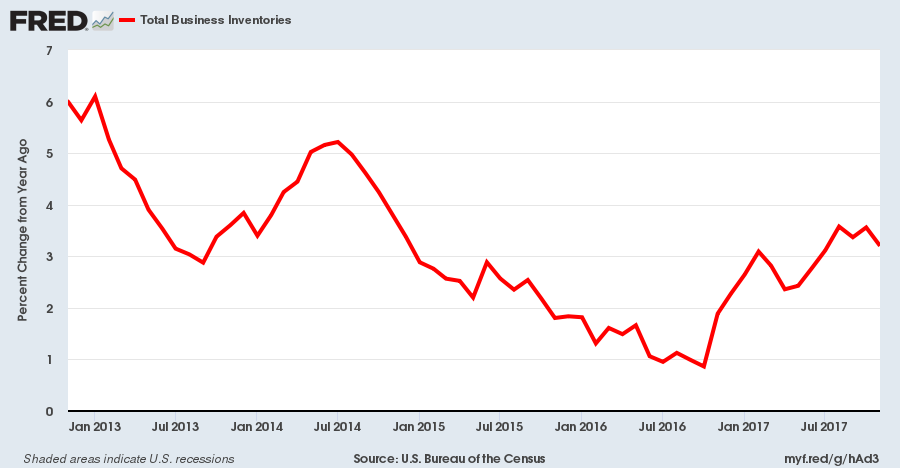

Businesses Turning Skeptical on U.S. Growth?

Lastly, pay attention to business inventories. They suggest that a recession could be looming in the U.S. economy.

Here’s what you need to know: businesses produce and build up inventories in times of economic growth. This could be because they expect high demand for their products.

Now, if their inventory buildup slows down, you have to question whether they are turning skeptical and are predicting an economic slowdown.

With this said, look at the chart below.

(Source: “Total Business Inventories,” Federal Reserve Bank of St. Louis, last accessed January 17, 2018.)

The chart shows the percentage change in monthly total business inventories in the U.S. economy.

Notice something that’s like the first two charts? The inventory growth rate has been declining. It essentially says that businesses are not so confident about demand, and are not so optimistic about the U.S. economy.

Where Do We Go from Here?

Dear reader, it can’t be stressed enough: it’s important to pay attention to data rather than the noise. The noise creates confusion while the data tells the facts.

The data is very loud and clear, saying there are problems persisting in the U.S. economy that haven’t really improved. The three charts shown above are just a few examples of this.

I believe that the latter part of 2018 could be very difficult for the U.S. economy. It will not shock me whatsoever if the gross domestic product (GDP) numbers start to hint at a recession.

Obviously, with time, we will know more. But keep in mind, if there’s a recession in the U.S., it could hit investor confidence hard. Investors could be looking for an exit, which could create a massive sell-off across various assets.